Our rankings of the best cryptocurrencies to buy now are grounded in a scientific, data-driven approach. We analyze each project by applying a proprietary methodology, normalizing evaluations with Z-scores to remove biases and ensure a fair comparison across varied market cap sizes, liquidity, and development stages.

According to our research, the best cryptos to buy on May 16, 2025 are Bitcoin, Ethereum, XRP, Solana, Cardano, Dogecoin, BNB, and Notcoin. Bitcoin stands out as the top choice, driven by recent ETF inflows and its role as a hedge against inflation.

Now is an opportune moment to invest in crypto, with the reversal of many of Trump’s tariffs restoring confidence across the markets.

Top Crypto to Buy Right Now

| Crypto | 24-Hour Price Change | Year-on-Year Return | Current Price | Market Cap |

|---|---|---|---|---|

| Bitcoin | +56.51% | $103,458.00 | $2.06T | |

| Solana | +4.84% | $170.52 | $88.62B | |

| XRP | +362.58% | $2.40 | $140.71B | |

| Ethereum | -14.70% | $2,575.50 | $310.94B | |

| Cardano | +68.44% | $0.77 | $27.25B | |

| BNB | +11.54% | $653.23 | $96.40B | |

| Dogecoin | +43.65% | $0.22 | $33.48B |

ℹ️ The cryptocurrency data in this table was last updated on May 16, 2025. The remaining data is updated weekly.

Best Cryptocurrencies to Invest in Today

We’ll start our in-depth reviews of the best cryptocurrencies to buy now with large-cap crypto coins that could provide the most reliable returns in the long-term. We update our list according to market trends and performance, as well as evolving utility and adoption.

Each factor in our ranking methodology is weighted, reflecting its importance in predicting success and reliability. This ensures that the crypto assets with the strongest performance across all metrics make the top of the list.

1. Bitcoin (BTC) — The Original Cryptocurrency, Known as “Digital Gold”

Bitcoin is the world’s oldest cryptocurrency and the largest by market cap by a wide margin. It’s the only cryptocurrency that’s officially recognized by many major governments, including the U.S. — it’s even used as legal tender in countries like El Salvador.

Its miner network, valued at over $400 billion, has operated flawlessly for over 15 years. It’s classified as a commodity by both the SEC and CFTC, held in sovereign reserves, and soon, part of the U.S. Strategic Cryptocurrency Reserve.

Key Highlights:

- Bitcoin price as of May 16, 2025: $103,458.00

- Market cap: $2.06T

- All-time high: $109,079.00

- 24-hour price change:

BTC +1.24%

- Bitcoin’s price has decreased in the last week with a change of -0.18%

- Year-over-year (YoY) return: +56.51%

Ethereum is the world’s second-largest crypto by market capitalization and the most widely used blockchain network for dApp development. The project was the first to introduce smart contracts when it launched in 2015.

Ethereum transitioned from the PoW to PoS consensus mechanism in 2022. The first spot Ether ETFs were approved in 2024 and the Pectra upgrade was just went live on May 7th 2025, promising improvements to the overall efficiency of the network.

Key Highlights:

- Ethereum price as of May 16, 2025: $2,575.50

- Market cap: $310.94B

- All-time high: $4,867.17

- 24-hour price change:

ETH +0.63%

- Ethereum price has increased in the last week with a change of +11.60%

- Year-over-year (YoY) return: -14.70%

XRP is the official crypto token of the Ripple payment network, which was built to make international payments faster and cheaper. The project is coming off a win against the SEC, which alleged that XRP was an unregistered security. XRP is now the third largest crypto by market cap.

Key Highlights:

- XRP price as of May 16, 2025: $2.40

- Market cap: $140.71B

- All-time high: $3.92

- 24-hour price change:

XRP -3.84%

- XRP price has increased in the last week with a change of +2.83%

- Year-over-year (YoY) return: +362.58%

Solana is a fast and cost-effective blockchain created as a challenger to Ethereum. It’s been one of the most successful crypto tokens of the resurgent crypto bull market, having increased +4.84% in value in the last 12 months. Solana is now the 6th-largest crypto by market cap and still has significant growth potential.

Key Highlights:

- Solana price as of May 16, 2025: $170.52

- Market cap: $88.62B

- All-time high: $295.40

- 24-hour price change:

SOL -1.12%

- Solana price has increased in the last week with a change of +3.48%

- Year-over-year (YoY) return: +4.84%

Cardano is a third-generation blockchain platform known for its scientific approach to development and an emphasis on interoperability and sustainability. It utilizes a PoS consensus mechanism, which is far more energy-efficient than the traditional PoW model used by older cryptocurrencies like Bitcoin.

Key Highlights:

- Cardano price as of May 16, 2025: $0.77

- Market cap: $27.25B

- All-time high: $3.10

- 24-hour price change:

ADA -1.38%

- Cardano price has decreased in the last week with a change of -1.53%

- Year-over-year (YoY) return: +68.44%

Dogecoin is the original meme coin, having launched in 2013. It was mostly unheard of until 2020-21, when it gained the attention of major celebrities including Tesla founder Elon Musk. Since Dogecoin’s explosive gain during the 2021 bull market, it’s inspired thousands of copycat meme coins — including highly successful ones like Shiba Inu and Pepe.

Key Highlights:

- Dogecoin price as of May 16, 2025: $0.22

- Market cap: $33.48B

- All-time high: $0.73

- 24-hour price change:

DOGE -1.72%

- DOGE price has increased in the last week with a change of +10.21%

- Year-over-year (YoY) return: +43.65%

BNB is the native token of Binance, the world’s largest cryptocurrency exchange. It powers a vast ecosystem, offering up to 25% trading fee discounts, priority access to token launches, and seamless utility across the Binance Smart Chain (BSC). For both traders and builders, BNB remains one of the best utility tokens in the market.

Key Highlights:

- BNB price as of May 16, 2025: $653.23

- Market cap: $96.40B

- All-time high: $792.40

- 24-hour price change:

BNB +0.22%

- BNB price has increased in the last week with a change of +3.28%

- Year-over-year (YoY) return: +11.54%

To determine what makes crypto worth buying, you need a data-driven, fundamentals-first approach. Whether investing short-term or building a long-term portfolio, evaluating each project using a clear set of criteria is critical.

Below, we break down the essential factors that separate promising cryptos from risky speculation so you can make smarter, more confident decisions.

1. It Has Long-Term Potential

When evaluating cryptos, start with long-term potential. For example, Bitcoin remains the leading store of value, while Ethereum dominates smart contract infrastructure — both are core holdings for serious investors.

Other major players show similar promise. XRP, for example, has partnered with over 2,500 financial institutions to support cross-border payments and could play a key role as a global bridge currency. Institutional and corporate adoption is also accelerating. From finance to gaming, brands are investing heavily in Web3.

2. It Has Real-World Utility

Cryptocurrency projects offering high utility, i.e., utility tokens, will likely be more sustainable in the long run since you can use the tokens within the ecosystem. This ensures long-term value and resilience and mitigates volatility.

To assess project utility:

- Evaluate adoption metrics, ecosystem growth, and developer activity.

- Ask yourself: Does the project solve a real problem or create efficiencies?

- Assess partnerships, integration potential, and tokenomics.

- Analyze the team’s expertise and transparency.

- Avoid projects with vague promises or speculative hype.

- Compare projects to understand trade-offs (e.g., Solana’s speed vs. Ethereum’s ecosystem dominance).

In essence, you should focus on projects solving real problems backed by strong fundamentals and adoption. This approach minimizes risk and increases the chances of long-term returns.

3. Its Market Cap Aligns With Your Goals and Risk Profile

Market capitalization reflects a cryptocurrency’s value and helps you gauge risk and growth potential:

Lastly, compare fully diluted valuations (FDV) to understand token supply inflation risks. This way, you can use the market cap to filter projects matching your risk tolerance and investment horizon.

4. The Project Is Unique and Stands Out

Always check how much competition a crypto project has. With over 14.9M tokens being tracked on CoinMarketCap and more launching daily, standing out is tough.

Take Ethereum. It’s the smart contract leader but faces constant pressure from “Ethereum Killers” like Cardano, which offers lower fees and faster speeds but hasn’t achieved the same adoption.

The same applies to meme coins. Many “Doge Killers” claim they’ll surpass Dogecoin, but few bring anything original. When one meme coin gains traction, dozens of clones usually follow.

Another good example is the DePIN sector. Render Network gained traction by solving a real problem — decentralized GPU rendering. But RenderX tried to ride the wave without offering any real innovation and quickly faded.

The bottom line? Always assess whether a project brings something new or just mimics what’s already working.

5. It Fits Current Crypto Trends and Narratives

Trends should not be discounted when deciding which crypto to buy today. Investing in trending cryptos, sectors, or narratives could be hugely beneficial if the timing is good, or disastrous if the trend is no longer popular.

If you spotted these trends early, you could have positioned yourself for massive returns. According to Messari’s 2025 Crypto Theses report, RWA, AI, and DePIN projects will likely dominate in 2025.

These sectors could produce the next wave of breakout projects, making them key areas to watch. Ensure you cash out before trends die.

6. Its Tokenomics and Incentives Are Sustainable

A crypto project’s tokenomics can make or break its long-term viability. You want to know precisely how the token is used, who benefits from holding it, and whether the supply and reward structures are built for growth or just hype.

Sustainable tokenomics reward long-term holders, fuel ecosystem growth, and help prevent death spirals when hype fades. If the incentives aren’t carefully designed, the project’s value may erode, regardless of how promising it looks on paper.

7. It Prioritizes Transparency and Regulatory Compliance

No matter how innovative a project is, it’s a red flag if it operates in the dark or skirts regulations.

While many crypto tokens operate in gray areas of legal law, some actively work to align with local laws, which reduces the risk of sudden delistings or enforcement actions.

Ask yourself:

- Is the team publicly known and accountable?

- Are the developers active in the community?

- Are smart contracts audited and results published?

- Does the project comply with KYC/AML standards (if relevant)?

- Does the project regularly publish updates, audits, or financial reports?

- Is there a legal entity or jurisdiction behind the token?

Projects prioritizing compliance and openness in a maturing market are more likely to survive and scale, making them safer long-term investments.

How Much Does It Cost to Buy Cryptocurrency?

The cost of buying cryptocurrency depends on a few key factors:

- The coin’s market price

- Transaction fees

- Platform spreads

First, each cryptocurrency has a real-time market price. For example, Bitcoin is trading at $103,458.00 and Ethereum at $2,575.50.

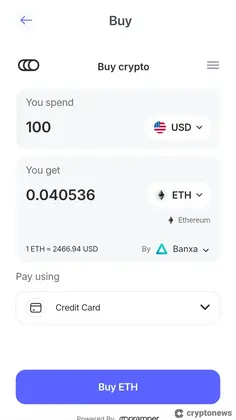

But that’s just the starting point. Most exchanges charge fees. Centralized ones like Coinbase, Binance, and MEXC charge anywhere from 0 to 1% as maker and taker spot trading fees. There’s also the spread (the difference between buy and sell prices), which subtly increases your cost.

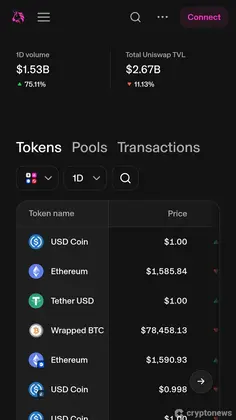

Some platforms like Robinhood offer “zero commission” trades, but often bake the cost into unfavorable spreads. On decentralized exchanges (DEXs), like Uniswap, you’ll pay a gas fee instead, usually $1–$50+ for Ethereum, depending on network congestion.

So, buying $1,000 of crypto could cost anywhere from $1 to $50+ in fees, depending on how and where you buy. Advanced users sometimes batch transactions or use Layer 2s like Arbitrum to cut costs significantly.

How to Buy Cryptocurrency

Buying cryptocurrency has never been easier. Whether you’re starting with Bitcoin, Ethereum, or altcoins like Solana or Avalanche. Most people buy through centralized exchanges like Coinbase or Binance, but you can also use non-custodial wallets for more control and direct access to DeFi and Web3.

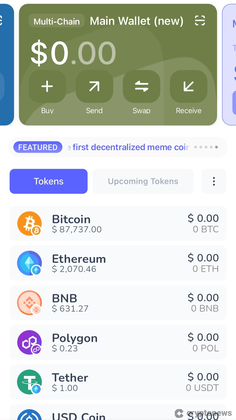

Best Wallet is an all-in-one solution, offering seamless crypto purchases and real-time tracking — all from within the app. Unlike other wallets, it supports in-app buying and portfolio tracking in a single, secure interface.

Here’s how to get started step by step:

1️⃣ Download and Set Up Best Wallet

Grab Best Wallet from the official website, App Store, or Google Play. Open the app and follow the prompts to create your wallet. Securely back up your recovery phrase, and enable biometric + 2FA protection.

2️⃣ Choose the Cryptocurrency

Use the Best Wallet interface to browse and pick the asset you want to buy. The wallet supports direct integration with DEXs, which broadens the coin selection.

3️⃣ Buy the Cryptocurrency

Select your preferred payment method — crypto or fiat — enter the amount, and confirm the transaction.

4️⃣ Track in Your Wallet Dashboard

Best Wallet gives you a clean, real-time overview of your holdings, including fiat value, performance, and individual asset details.

Weekly Crypto Market Overview

Bitcoin has reclaimed $100,000 and is now clustering near $104,000 after a $105,525 spike. Sustained ETF inflows above $5B, plus Strive’s pending $1B BTC buy, squeeze supply. Basis doubled week-over-week, yet leverage remains below 2024 highs, leaving upside toward $110,000.

Ethereum surged 32% in two days following its Pectra upgrade, introducing smart accounts and scaling improvements. The ETH/BTC ratio rebounded, signaling renewed investor confidence. Funding rates remain moderate, suggesting further upside potential if market sentiment stays bullish. Analysts are soon watching for a possible retest of the $3,000–$3,500 range.

Altcoins saw renewed interest as capital rotated out of Bitcoin:

- Solana led inflows, while Arbitrum and Dogecoin posted significant gains.

- Polygon outpaced Ethereum in USDC activity for a second month, showing strong adoption.

- Layer 2 and meme coins continue to dominate trading volumes across major exchanges.

- Tokenization efforts gained momentum with 21Shares launching a CRO ETP on Euronext and Superstate expanding tokenized equities on Solana.

- Stripe’s stablecoin accounts for businesses in 101 countries further illustrate the accelerating shift toward blockchain-based financial infrastructure.

These developments point to growing institutional confidence in crypto-native financial products.

Looking ahead, critical events to monitor include US CPI data, China’s inflation report, and Geneva tariff negotiations. Central banks like Banxico and Riksbank may adjust policy stances, impacting global risk sentiment. Derivatives markets remain stable, but macro surprises could trigger volatility across crypto assets, particularly in leveraged positions.

Post courtesy of cryptonews.com.