As the housing market, locally and nationwide, boomed during the height of the Covid-19 pandemic, there has been a result of a lack of inventory. In the last couple of months, the inventory has been slowly rebuilding as have the mortgage rates. But which has impacted this fluctuation more: mortgages rates or elevated home prices?

Single family home prices have increased by 17.8% (median price) from July 2021 to July 2022 according the Durango Area Association of REALTORS®. Colorado has also experienced a 10.5% median price increase from July 2021 to 2022 based on the Colorado Association of REALTORS® statewide statistics. The supply and demand theorems have prodded the price up and the quickness of sales since the summer of 2020. With these elevated prices, the market has priced out a lot of potential homebuyers, with many more still entering bidding wars.

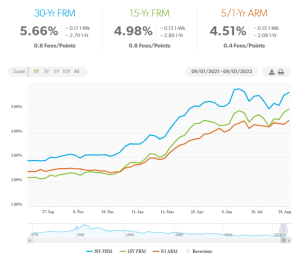

Looking at Freddie Mac, the 30-year federal mortgage rates have gained over 2%, reaching just under 6% in June, since the beginning of 2022. Mortgage rates play a big role in purchase power for homebuyers. The higher the mortgage rate, the more interest is being collected, and therefore less money available to go towards the home price. Even with a 1% rise, the amount of people willing to decrease significantly and vice versa with a 1% decrease, there will be more potential homebuyers that are financially able to enter the real estate market.

With these factors, our local La Plata County real estate market has started to balance out the buyers/sellers market with a smaller average price month by month. With the increasing inventory we are starting to see more and more price reductions as well as a continuation of sales keeping our market moving.

Please don’t hesitate to reach out with any questions you may have about the real estate market as we would love to assist you!

Post courtesy of The Durango Team